Even though various financial statement metrics can be found on different web sites and broker sites, maybe you want to investigate the metrics yourself. Below are some hypothetical example statements to assist in your studies. But first it’s important to know, the primary rules companies use to generate financial statements allow for flexibility in layout and order of cash inputs and outputs. It is so generalized, that the official name is referred to as Generally Accepted Accounting Principles (GAAP). So just be aware, the names and labels used to identify entries within financial statements vary from one company to the next (generally speaking).

In the financial statements that follow, entries with a yellow highlighted legend containing an orange arrow are values which different Ratio Equations use. The ratios are explained in detail at the fundamental metrics link. To see the exact use of these highlighted entries in an equation requires clicking on the different fundamental Metrics.

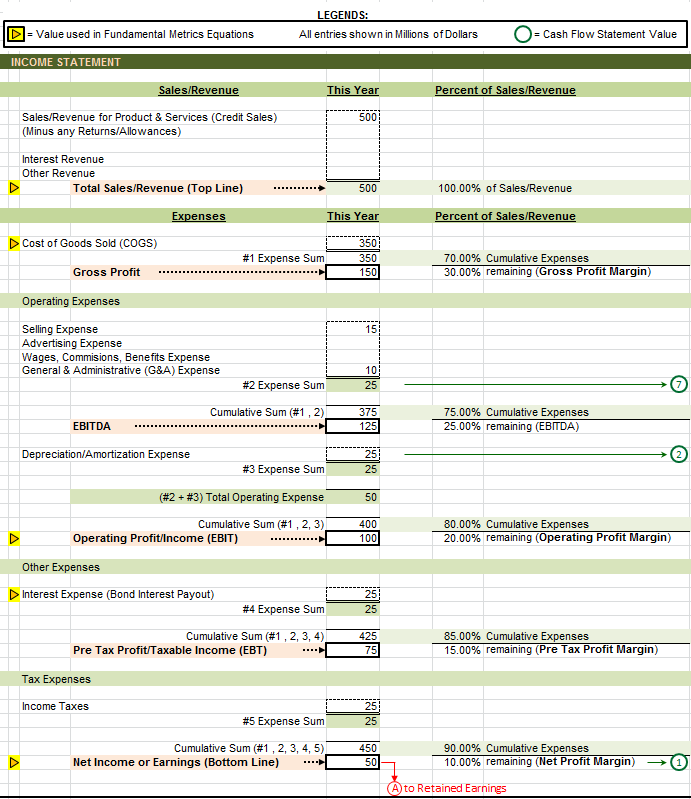

Income Statement

Income Statement – shows Profitability or economic performance

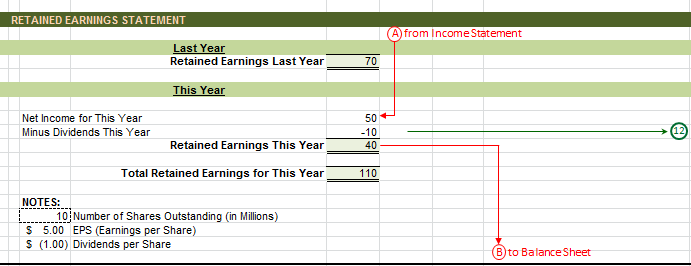

Retained Earnings Statement

Statement of Retained Earnings

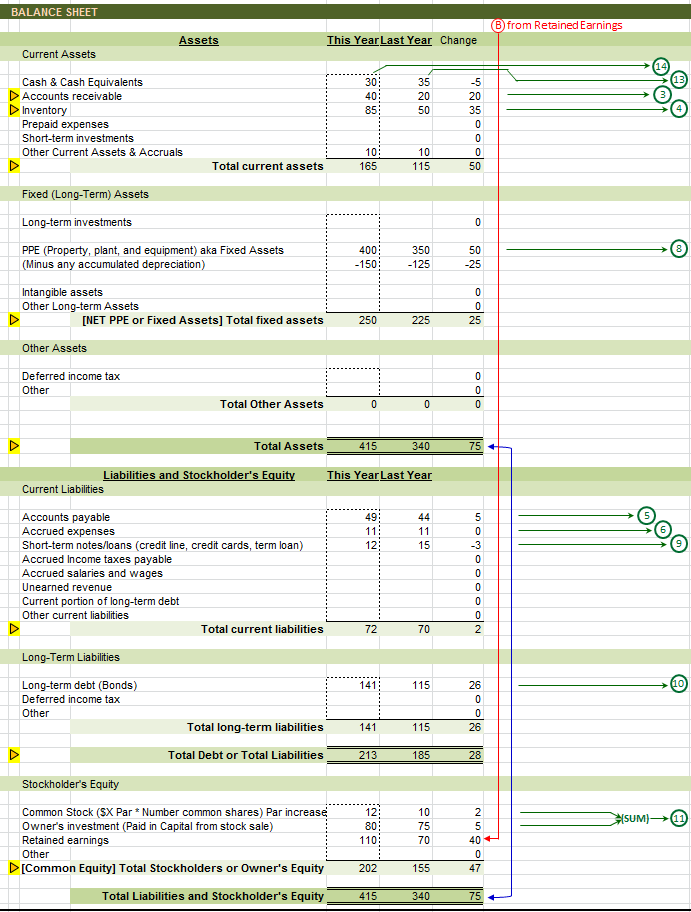

Balance Sheet

Balance Sheet – shows Liquidity or ability to acquire cash and therefore pay debt

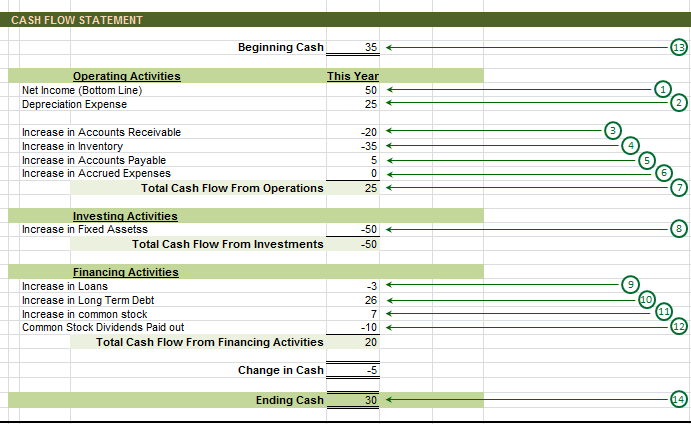

Cash Flow Statement

Statement of Cash Flows – shows Solvency or ability to pay debt